Stay-up-to date with our latest news and follow the stories that shape our industry!

nl

en

About us | News

Latest news

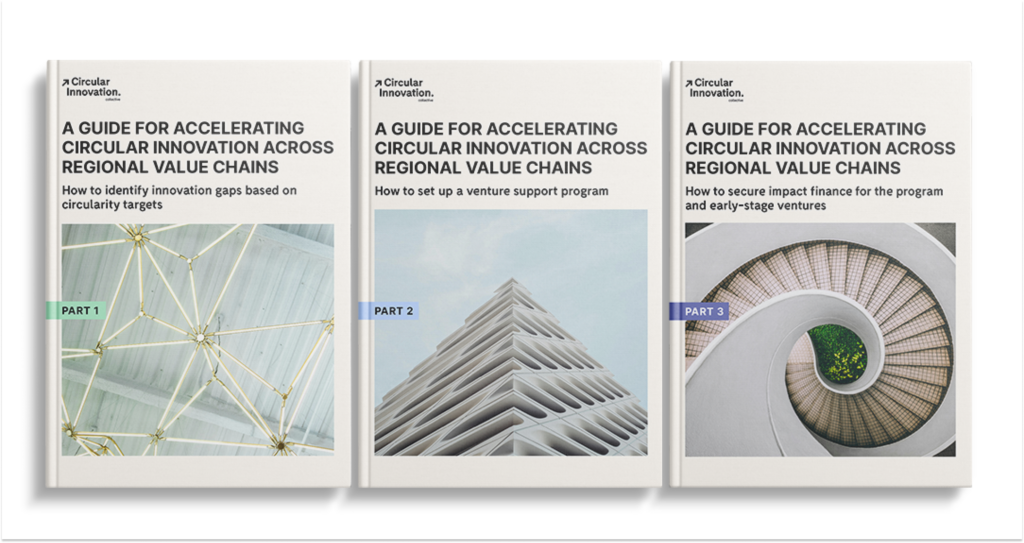

11 March

After a successful pilot with the Metropolitan Region Amsterdam, the Circular Innovation Collective has published an open-access guide to advance circular innovation programs across European cities and regions.

7 February

Innovating in the brewery sector is not always easy. But it is much needed in these times. Seven breweries and a wholesaler inspired each other and collaborated on a plan to brew in a more sustainable way. This happened during the CIRCO Track Beer Brewing. In this three-day training program, entrepreneurs work together to explore their opportunities in the field of circularity.

15 January

In a world that is constantly evolving, awareness is emerging about our impact on the planet and the crucial role we play in shaping a sustainable future. Especially in the fashion industry, where creativity and expression go hand in hand with production and consumption, the forces of change are fueled by both conscious consumers and forward-thinking companies.

15 January

In the fashion world, there are constant developments in the field of materials, with designers seeking innovative and sustainable options. While many of these materials show promise, their adoption in the fashion industry depends on various factors, including availability, cost-effectiveness, scalability, and consumer acceptance. Nevertheless, the quest for new, sustainable materials remains a key focus within the fashion industry to contribute to a more environmentally friendly and responsible future. We highlight three examples of innovative companies applying materials and their potential in practice.

8 January

The importance of material choice and use throughout fashion textile chain has been a topic of discussion for some time, and with good reason. Its also important to discuss how consumers can be offered options for taking good care of clothing so that it can be used for longer, making it more sustainable in turn. This article by Fashion United Benelux discusses both of these topics, and how new revenue models are needed in collaboration with fashion brands that can make a circular textile chain possible.

20 December

Small and medium-sized companies (SMEs) are realising how crucial it is to go green in their day-to-day operations. It's not just about doing the right thing; it's a smart move that can really pay off. Here are five reasons why it makes sense to engrain sustainability into the core of your business.

11 October

Sollas, a well-known designer and manufacturer of high-quality product overwrapping systems, has recently teamed up with Impact Hub Amsterdam. We helped Sollas explore potential partnerships for the development of an innovative and sustainable paper equivalent to currently widely used plastic overwrapping film.

28 September

As of 2022, some 2.2 billion people still lack access to safe drinking water, an issue that's becoming more serious as water stress caused by climate change continues to increase. Tackling water stress worldwide requires collaboration and innovation – whether in new approaches to existing technologies or completely novel solutions. What Design Can Do's Make it Circular Challenge winner LibreWater combines both approaches with its Open Source Hardware desalination device. The design will be shared free of charge for local production. Everybody is welcome to adapt, build, change, or sell it.

14 August

AM District Development teamed up with Impact Hub Amsterdam to explore innovative partners that process crops such as elephant grass (Miscanthus), mycelium and bamboo into construction materials, ranging from brick to insulation and textiles.

4 July

The fashion paradox – how can an industry brimming with creativity and self-expression have such a negative impact on people and the planet? That is the question Anne-Christine Polet, founder and head of Stitch, asked at the beginning of her inspiring talk during our Fashion and Textile Ecosystem Day on 21 June.

6 June

More and more consumers prioritise environmentally conscious products; consequently, many businesses are following suit. From biodegradable materials to reusable solutions, companies are implementing eco-friendly practices to meet the growing demand. We have handpicked a selection of our favourite startups with game-changing sustainable packaging solutions that we believe will lead the way in the future.

23 May

Since 2018, we have been working on building and co-hosting a Sustainable Food Ecosystem in the Netherlands with partners DOEN Foundation, the Ministry of Food, Nature and Food Quality, and Food Hub, amongst many others.

20 March

Now more than ever, we need forward-thinking designers to come up with sustainable solutions. If frustration about the billiard ball shortage is enough of an incentive to invent something radical, the survival of our planet should be able to inspire new solutions 100 times faster. Designers are absolutely crucial here as 80% of the environmental impact of a product is decided in the creation stage.

Luckily, more and more brave and forward-thinking designers are starting companies that make investors want to jump in.

7 March

In celebration of the upcoming International Women’s Day, we would like to put the spotlight on two inspiring women from the Food Pioneers Programme. Learn more about the way they add value to your plate, one bite at a time!

16 February

In 2030, seventy percent of the textile industry in the Amsterdam Metropolitan Area must be circular – an ambitious goal. Yet the textile industry is slow to move in that direction, says Manon Klein. Klein is director of Impact Hub Amsterdam, an impact innovation company that, together with Metabolic and Bankers Without Boundaries, has designed an innovative approach to drive circular system change, starting with the textile sector.

5 December

The 2022 edition of Unpack Impact, a yearly event organised by Impact Hub Amsterdam and the City of Amsterdam (Amsterdam Impact) to bring entrepreneurs and investors closer together, took place on the eve of Black Friday and tackled the theme of Investing in Degrowth.

31 October

27 October

In 6-months, these startups will take their business to the next level through training and guidance by Food Hub, Impact Hub the Netherlands, and Flevo Campus professionals. Meet the new batch of startups joining this edition of the Village Food Pioneers program!

11 October

The Impact the Food Chain Accelerator, part of our Food Ecosystem, is 5-month growth programme for impact entrepreneurs who work on the transition towards a more sustainable food system. For the 2022 edition, we have selected 10 startups that focus on sustainable proteins, short and/or fair supply chains, biodiversity, food waste, or access to healthy & sustainable food.

5 October

Marcel den Hollander gave a keynote during our Circular Ecosystem Day. Marcel works as an independent researcher and industrial design consultant to industry in circular product design and business models for the circular economy. As one of the first he studied industrial design at the TU Delft followed by a Ph.D in circular product design and with over 20 years of experience in commercial industrial design for renowned design studios, designing consumer goods from (food)packaging to office furniture.

3 May

In 6-months, these startups will take their business to the next level through training and guidance by Food Hub, Impact Hub the Netherlands, and Flevo Campus professionals. Meet the new batch of startups joining this edition of the Village Food Pioneers program!

3 May

An app that offers a listening ear, an electric modular boat, crochet clubs and a neighbourhood lab. These are only 4 of the 30 participants of Boost je Buurt 2022 (Dutch for Boost Your Neighbourhood), an initiative of Amsterdam Impact, the City of Amsterdam’s impact entrepreneurship programme.

16 February

Today we are seeing a growing number of designers embrace the shift towards a circular economy. For many this starts with reimagining products and services in a way that eliminates waste and supports a more regenerative relationship with nature. But as some of us come to find out, having a good idea and translating it into real and lasting impact are two very different things. What could creatives do to help turn their circular design into a thriving enterprise?

13 January

In recent years, impact entrepreneurship has received great attention in the Netherlands. Not only amongst entrepreneurs but also from financiers and governments. But there is still plenty of room for improvement, according to Ilse Kwaaitaal and Manon Klein, the new directors of Impact Hub the Netherlands since January.

1 December

The meaning of 'regenative', bonds for argiculture & stakeholder involvement. Discover what was discussed during the hybrid online and in-person 2021 edition of our Unpack Impact event, featuring panelists Liesbeth Soer, director of catalytic investments at Triodos Regenerative Money Centre; Danielle de Nie, soil scientist and founder of Wij.land; Brad Vanstone, founder of plant-based cheesemakers Willicroft & Joel Solomon, Impact Investor & founding partner of Renewal Funds.

16 November

For the #21 edition of the Business Model Challenge, we selected 9 impactful startups that make a real difference. They introduce sustainable fashion, empower women in tech, and much more. Read on and get to know them.

10 November

We are proud to announce that Tatiana Glad is taking on the role as Executive Director for the global Impact Hub Network as of January 1, 2022. The leadership of Impact Hub Amsterdam will be taken over by Ilse Kwaaitaal and Manon Klein

19 October

The Impact the Food Chain Accelerator, part of our Food Ecosystem, is 5-month growth programme for impact entrepreneurs who work on the transition towards a more sustainable food system. For the 2021 edition, we have selected 7 startups that focus on sustainable proteins, short and/or fair supply chains, biodiversity, food waste, or access to healthy & sustainable food.

18 August

We are halfway through Impact Nation 2021! After defining their respective sustainability challenges, we matched Kapimex, AmperaPark, and ABN AMRO to up to 3 innovative companies ready to solve these challenges. On 23 June, all three challenge owners selected their best match! In the coming 100 days, they will work together to build a Minimum Lovable Product. We will provide them with support and facilitate regular check-ins, so the three teams will be ready to present the outcome of their collaboration(s) to an audience of various stakeholders on Demo Day.

22 July

We are proud to share the highlights from our community and offerings over the last 2 years. We also mention the initiatives dear to our Hub hearts that we delivered in response to the fallouts of Covid-19. In this report, you can read about how we live our purpose and values as an impact business, as well as the impact we have made with our community through our thematic ecosystems to entrepreneur change in food, circularity, fashion, and inclusion.

14 April

In three months, these startups will finetune their business plan, strengthen their entrepreneurial skills, and expand their impact business network. Meet the new batch startups that joined our themed edition of Business Model Challenge (BMC) focusing on inclusion!

14 April

In three months, these startups will finetune their business plan, strengthen their entrepreneurial skills, and expand their impact business network. Meet the new batch startups that joined our twentieth Business Model Challenge (BMC)!

18 March

The Investment Ready Program, whose main partner is ING Netherlands Foundation, is our five-month accelerator for circular impact entrepreneurs with scalable solutions to global problems. We guide a cohort of selected participants through a systematic review of their business strategy, model, and team before they craft a validated growth and investment plan. We do this to help them attract the right investor and secure funding that matches their growth ambitions. This year, the Investment Ready Program went international!

10 March

Soup that combats food waste and elderly loneliness, a gallery for artists with a psychological vulnerability, and serving boards made from the reclaimed wood of locally felled trees. These are just three of the 27 participants of Boost je Buurt (Dutch for Boost Your Neighbourhood), an initiative of Amsterdam Impact, the City of Amsterdam’s impact entrepreneurship programme.

17 February

Last summer, we published our research into how COVID-19 affected impact entrepreneurs in the food sector. Up next, the follow-up! How are they now and what happened in the meantime?

11 February

11 January

As Impact Hub the Netherlands turns 12, we’ve decided to make some changes to unleash its higher potential. Our vision, when we started in 2008, was ambitious: a radically better world. In 2020 we take a stand for a fully green and inclusive economy, and draw from our long-standing work with innovators to collectively pioneer change in the mainstream: Impact Hub the Netherland's new level of ambition is born.

18 December

16 December

Iron Roots© was founded in 2017, by Ashkan, Stefan & Erik, three friends that were fed up with the fact that more than 90% of all sportswear was made from plastics. When they didn't find a good alternative, they decided to take matters in our own hands.

14 December

In 2015, the City of Amsterdam and Impact Hub the Netherlands started a relationship to share ideas, networks, actions and reflections to make the city’s growing social entrepreneurship ecosystem more explicit and better equipped. We are pleased to share what our partnership has accomplished and what we have learned.

8 December

Joost de Kluijver is al een lange tijd werkzaam in de mobiele telefonie sector. De telefoon is een icoon geworden van technologische vooruitgang, stelt hij. Met zijn bedrijf Closing the Loop voorkomt Joost dat telefoons na een aantal jaar trouwe dienst op de vuilnisbelt terechtkomen.

1 December

For the fourth edition of our SDG Meetup series, organised with C-Change and SDG House, we explored gender equality, which aims to empower all women and girls around the world.

30 November

The Investment Ready Program, whose main partner is ING Netherlands Foundation, is our five-month accelerator for circular impact entrepreneurs with scalable solutions to global problems. We guide a cohort of selected participants through a systematic review of their business strategy, model, and team before they craft a validated growth and investment plan. We do this to help them attract the right investor and secure funding that matches their growth ambitions. Read on to meet the IRP alumni of 2020!

25 November

As we get closer to the lucky 13th edition of our Business Model Challenge (BMC) accelerator, which already helped 270 startups develop a better business model, here’s what you can learn from the top 3 finalists of the previous BMC edition.

18 November

In 2015, the City of Amsterdam and Impact Hub the Netherlands started a relationship to share ideas, networks, actions and reflections to make the city’s growing social entrepreneurship ecosystem more explicit and better equipped. As we reflect on three years of collaboration, we are pleased to share what our partnership has accomplished and what we have learned.

8 November

You can’t deny it: the circular economy is booming. De Brauw Blackstone Westbroek is our partner and gives Impact Hub members and program participants legal advice in setting up or running an impact business.

30 October

We investigated how impact entrepreneurs in the food sector and their stakeholders were affected by the COVID-19 crisis and identified interventions that can accelerate the transition to a sustainable food system.

25 October

The Young Impactmakers community hosted a Sustainable Travels event and invited impact-driven enterprises to pitch their ideas on environmentally and socially responsible ways of travelling.

22 October

Impact Hub the Netherlands, Amsterdam Impact (the City of Amsterdam’s impact entrepreneurship programme) and ABN AMRO organised a 5-day digital soft-landing visit to Berlin for 6 sustainable food companies looking to expand into the German market.

18 October

In this special SDG Meetup, we explored inclusion from the same plural perspective, through the lenses of SDG 5: Gender Equality, SDG 10: Reduce Inequality and SDG 11: Sustainable Cities and Communities. Keep reading to find out how Klabu, WelcomeApp and Meer Vrouwen in de Politiek (Dutch for ‘More Women in Politics’) contribute to achieving one or more of these SDGs.

8 September

Impact the Food Chain Accelerator, part of our Food Ecosystem, is a 5-month program for impact entrepreneurs who work on the transition to a more sustainable food system. For the 2019 edition, we selected 12 startups that focus on shorter and fairer value chains, circularity against food waste, or sustainable (alternative) products.

27 May

Originally founded as ‘The Hub’ in 2005 in a 4th floor reclaimed space in London's Islington, Impact Hub has grown bottom up into a global ecology of social innovation communities across 50 countries. Read about its early years!

24 May

The inspiration to write this article is based on a series of experiences spanning the co-building of our Impact Hub in Amsterdam, working with TILT to host a collaborative space design process with Impact Hub Siracusa, witnessing the evolution of Elos Institute’s work with the Oasis Game in (re-)building neighbourhoods, and a community conversation in (previously existing) Impact Hub Seattle exploring “How can we together create a collaborative, inspired, and connected place that will powerfully support and accelerate our entrepreneurial work, our collective impact and our mutual success?” These events - coupled with my work in community-building in diverse settings and cultures - have led me to see collaborative space-making as a living process and practice much needed in our places.

14 April

Business plays a significant role in driving societal evolution. It provides livelihood support for billions, fuels progress, and offers a way to freedom and independence. Social enterprises attempt to put purpose at the core of business endeavors for a better result on people, planet, and profit. However, no business is safe from risk. Today, many businesses are bumping up against hardship as they continue to be informed by outdated economic paradigms and run with strained management practices even as they face increased competition. When the inevitable challenges surface for social enterprises, do they honor their purpose or default to economic imperatives?

28 June

We have all experienced the messiness of collaboration: the divergent perspectives that we wonder how to marry, the many coloured post-its that litter the walls having grown out of their intended organised-by-cluster layering, the agreed action steps that lost original inspiration as soon as the group re-encountered the everyday life of email and phone calls. What makes collaboration worth it?

26 May

Social entrepreneurs and governments speak different languages. However, understanding each other is essential to achieve quality of life through the businesses we start, grow and scale.

26 April

On November 2014 at Impact Hub the Netherlands, 30 civil servants, politicians and social entrepreneurs were brought together for a two-part innovation lab - named the Societal Renewal Lab - where a dedicated group with diverse perspectives was invited to take a deeper dive into understanding the system constraints that get in the way of collaboration around shared goals for a healthier society. We focused on the question: How can we create an enabling environment for social enterprising?